Being Mindful of Money & Saving in 2015

We've always been pretty mindful of our money. We've learned some hard lessons about debt, getting out of it and saving. I'm pretty thrifty, I shop with coupons all the time, buy mostly stuff on sale and we save for big purchases.

But, I know in 2015 we have some financial goals we want to meet. And in order to accomplish them we're going to have to be a little more mindful and strategic. Here's how I'm being a bit more mindful in 2015 with our money.

01// Having a Double or Nothing Savings Plan.

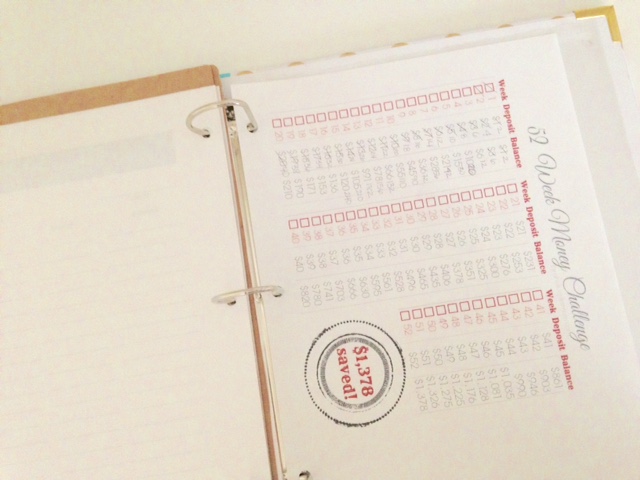

I'm sure you've seen those 52 week savings plan all around the internet. You know those one's where you save $1 the first week, $2 the next week, $3 the third week and so on till you're at $52 for the 52nd week in the year. And at the end of the year you've saved $1378 without even trying. This year I decided we've save double since we could in addition to what we're already saving. I'm using this worksheet to track it and just put away double the amount that it says on the worksheet instead.

02// Buying only when things are on sale, clearance or I have a discount.

I mentioned above that I already do this a lot, but there are times when I don't always do this. Like those times when you walk into Target and think if I don't buy this now, they won't have it when I come back!?! Yeah, those are really just mind games I play with myself and really a lie from the enemy to get me to break my budget rules. The last six months of last year I started doing this philosophy, and you know what I learned? Everything goes on sale, always. Old Navy always has a sale, do not buy that clothing item till it goes on sale. Two, it's worth waiting for a sale or coupon. At least it is for me. So this year I committing to only buying items if they fit into one of those categories above, it'll also give me time to really think about if I need the item.

03// Waiting till I run out of something before buying more.

This is specifically for toiletries and beauty products. I consider myself kinda a product junkie, I love trying new products but under my sink is beginning to look a little crazy outta hand. So this year I've committed to using every last drop of lotion, dry shampoo, hairspray whatever before buying more.

04// Making sure there's a place & purpose for everything new thing we bring into our home, or we don't.

Last year I participated in White House Black Shutter's 40bagsin40 days challenge. And it was quite a learning experience after going through and purging our home, donating and getting rid of what we don't use or need. I regularly twice a year go through our home anyway, I also get rid of my kid's clothing or donate it as they grow out of it. But this challenge showed me even more that I need a purpose and a place for everything in our home, otherwise it's just clutter and a waste of money. Having this mind set is going to make me much more intentional about the things we purchase.

These are just some of the ways we're trying to be more intentional this year with our money, I'd love to hear some of your own thoughts? What ways are you trying to save more or be more mindful this year? Share them in the comments below.